Where did my money go? A Christian money mindset guide to tracking finances without fear

- Sep 23, 2025

- 3 min read

Updated: Oct 22, 2025

Do you ever catch yourself saying, “Where did my money go?”

It’s a question I hear often from Christian women entrepreneurs. Many are earning more than before, yet at the end of the month, they feel like they have nothing to show for it. If that’s you—you’re not alone. And if you’ve been avoiding your finances out of fear or shame, I want you to know that it doesn’t have to stay that way.

Today, we’ll talk about why tracking your money matters, why so many avoid it, and how you can start with a simple, fun step that removes the overwhelm and helps you take back control.

Why knowing where your money goes matters

When I asked a client what made her invest in coaching despite her fears, she told me:

“I want to manage my personal finances better. I would like to reduce the tension between my husband and I. I know that if I don't get a handle on my personal finances, I will not be able to handle my business finances well. I want to know and understand my numbers and have a plan in place to accomplish my financial goals.”

Her words highlight the deeper reason behind tracking your spending—it’s not just about numbers.

It’s about peace in your relationships, confidence in your business, and clarity in your calling.

Scripture reminds us: “Know well the condition of your flocks, and give attention to your herds” (Proverbs 27:23, ESV). Stewardship begins with awareness.

Why so many women avoid looking at their finances

If you’ve been ignoring your money, chances are you’re not lazy—it’s fear or shame holding you back.

fear of what you’ll find when you look

fear of feeling overwhelmed or inadequate

fear that it will take too much time

shame about past decisions that makes you want to hide

But here’s the thing: avoiding your finances is a form of self-sabotage. It keeps you stuck in the very stress you want to escape.

The truth? Facing your numbers is rarely as painful as you imagine—and it’s always more freeing.

The first step: make tracking fun

Most people jump straight into budgeting, but that often feels restrictive and frustrating.

Before you set limits, you need to know your habits and patterns. That’s where tracking comes in.

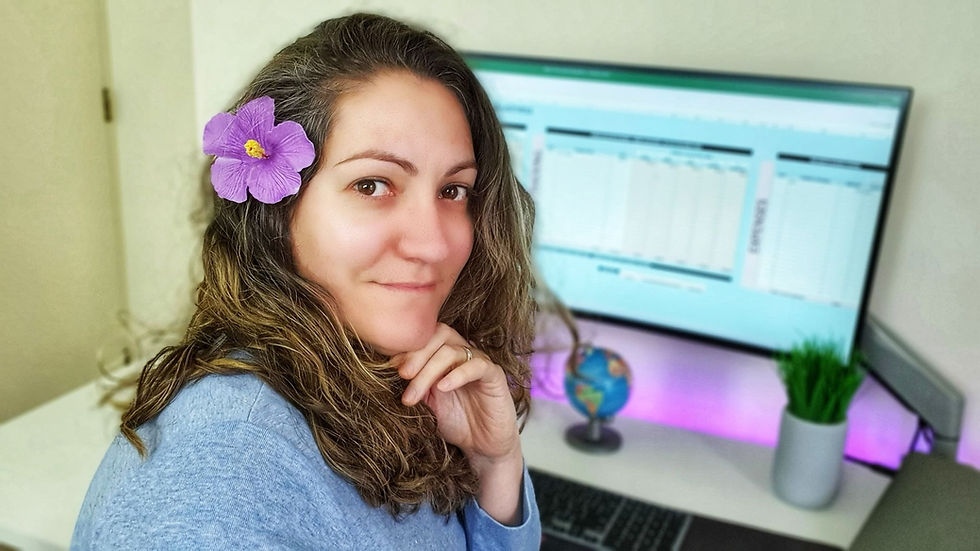

To help you start, I created the fun money tracking challenge. It’s a simple, free challenge designed to help you notice where your money goes without judgment—so you can finally face your finances with curiosity instead of fear.

Think of it as a low-pressure way to build awareness while developing fun money habits that you’ll actually want to stick with.

Join the fun money tracking challenge HERE

What happens when you know your numbers

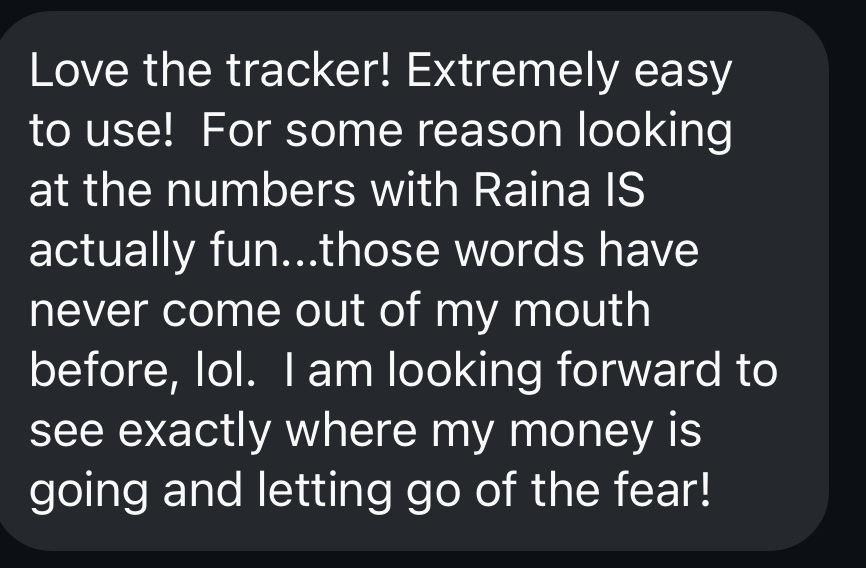

Here’s what my clients experience once they start tracking:

less overwhelm because they finally know what they’re dealing with

less stress because they’re not constantly wondering, “can I afford this?”

more clarity about what spending aligns—or doesn’t—with their values and goals

more confidence to make financial decisions rooted in faith instead of fear

This is where transformation begins. With awareness comes the ability to make changes—and with the right money mindset, those changes stick.

The bigger picture: stewardship with God’s Word

Here’s the reality:

you can’t pay off debt if you don’t know where your money is going

you can’t save or give more if you don’t know your numbers

you can’t build a sustainable plan if you’re avoiding your finances

But when you face your numbers with God’s wisdom, fear and shame lose their grip.

You begin to see money not as a master but as a resource God has entrusted to you.

From avoidance to empowerment

Many Christian women entrepreneurs tell me they feel guilty for avoiding money. But here’s the reframe: avoidance is not your identity, it’s just a pattern. And patterns can be broken.

That’s exactly what I help my clients do: break the cycle of avoidance and self-sabotage, renew their minds with God’s truth, and build money routines that feel fun, freeing, and faithful.

You are not alone.

If you’re asking yourself, “Where did my money go?”—take that as your invitation to start fresh.

begin with the fun money tracking challenge HERE to build awareness without fear

notice what your numbers reveal with curiosity, not shame

remember: stewardship is worship. You’re not doing this alone—God is your provider and guide.

And if you’re ready to go deeper—if you want to stop avoiding your finances, stop self-sabotaging, and finally feel confident as a steward of God’s resources—I invite you to book a free call with me

Together, we’ll talk about how to transform your money mindset so you can walk in peace, clarity, and joy with the resources God has entrusted to you.

I am looking forward to talking with you.

Take care

Raina | Biblical Mindset Discipleship Coach AKA The Fun Money Coach